Who Do You Make A Car Accident At Work Claim Against?

In this guide, we will explore how to make a car accident at work claim. You can learn more about accidents involving work vehicles and when your employer might be found liable, as well as split liability claims. We also look at how you could strengthen your claim and what evidence you could supply.

Included is a compensation guideline table to help you understand how much you could potentially receive. We also explore examples of what costs you could recover under special damages. In addition, we look at the Whiplash Injury Regulations and how these could impact your claim.

If you’re able to file a claim, you might find the process simpler with a No Win No Fee solicitor.

To contact our advisors:

- Call on 020 3870 4868

- Use the live chat features

- Or, start your claim online

Select A Section

- How Do Commercial And Work Vehicle Accidents Happen?

- Liability For Work Vehicle Accidents

- Commercial Vehicle Accident Statistics

- How Do You Prove Liability For A Car Accident At Work Claim?

- Calculating A Car Accident At Work Claim

- Learn More About Making A Car Accident At Work Claim

How Do Commercial And Work Vehicle Accidents Happen?

If you’ve been injured in a car accident while at work, you may be able to claim compensation if your injuries were caused by employer negligence. Employers should take reasonably practical steps to ensure risks are reduced, including work vehicle safety. This not only includes ensuring that the vehicle is safe to drive, but that you have the necessary requirements to drive that particular vehicle.

Injuries leading to a car accident at work claim could arise when employers fail to reduce risks connected with work vehicles. For example, this could include failing to maintain regular vehicle inspections or asking you to drive a vehicle you are not licensed to operate.

Our advisors can help you start your car accident at work claim if you contact us today.

Liability For Work Vehicle Accidents

You could make a car accident at work claim if you were injured due to negligence, even if you do not own the vehicle. Under the Health and Safety at Work etc. Act 1974 (HASAWA) your employer is expected to take reasonably practical steps to reduce workplace risks. This can include operating company vehicles.

Employers’ Liability

As part of their duty of care, your employer should ensure that not only is the workplace transport safe to operate, but that you have the necessary training operate that vehicle. This means that you have to be correctly insured, trained, and a competent driver.

If they have not taken reasonable steps to ensure the safety of that vehicle or your ability to drive safely, then you might be able to file a car accident at work claim. An example would be if you fail to stop due to faulty brakes if it was up to your employer to maintain regular checks. You could be injured crashing into a barrier.

Employees’ Liability

There are some situations you cannot claim for. This is because when you make a claim against your employer, you must be able to prove that their negligence led to your injuries.

Some examples of situations you may not be able to claim for include:

- If you were not licensed (where necessary) to drive the vehicle but chose to anyway.

- The injury occurred due you driving dangerously.

- If you were injured but your employer had taken appropriate measures to prevent you from harm.

You might be able to make a split liability claim if you were partially at fault, such as if you were driving negligently, but the brakes cut out. A split liability claim would reduce the amount of compensation you could receive. This is to reflect your role within the accident.

If you would like to discuss the circumstances leading to your potential car accident at work claim, our advisors are standing by.

Commercial Vehicle Accident Statistics

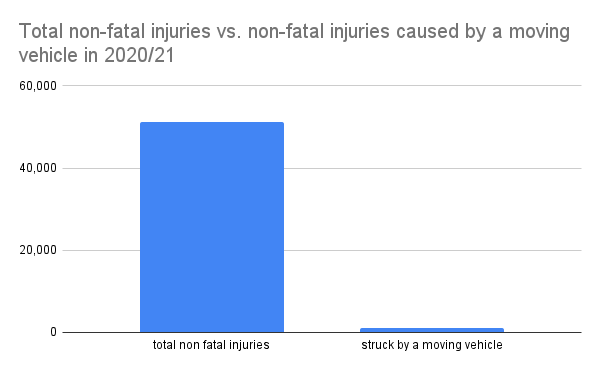

51,211 total non-fatal injuries were reported under the Reporting of Injuries, Diseases and Dangerous Occurrences Regulations 2013 (RIDDOR) during 2020/21. The Health and Safety Executive (HSE) provides figures of workplace injuries, including for work-related road safety.

How Do You Prove Liability For A Car Accident At Work Claim?

If you have been injured in a car accident at work due to employer negligence and would like to make a claim, you will need to supply evidence. Actions taken after the accident could help strengthen your claim.

If it is safe to do so, these actions could include:

- When the accident involved another party, getting their name, telephone number, registration number and insurance provider’s details. If they are untraceable or an uninsured driver, you might be able to claim through the Motor Insurers’ Bureau (MIB).

- Witness details. Make a note of witness contact details as they may be able to provide a statement at a later date.

- Medical attention. Medical records from a doctor or hospital visit could be submitted. If you are claiming compensation, you might also be invited to an independent medical assessment.

- Report the accident in the workplace logbook. You could do this as soon as possible after the accident to ensure the details are still fresh. Include your name, the time and date, and relevant details.

- Take photographs. Damage to the car, plus your injuries could be photographed.

To discuss what evidence you could submit, speak to our advisors.

Calculating A Car Accident At Work Claim

If you decide to file a car accident at work claim, your claim could have two heads: general damages and special damages. We explore examples of each below.

General Damages

General damages relate to the physical injuries and any emotional distress connected to them. The Judicial College Guidelines (JCG) is a document that provides potential compensation brackets for injuries. Solicitors refer to it when assigning value to claims. Some examples from the JCG are provided below.

| Injury | Potential Compensation | Notes |

|---|---|---|

| Moderate brain damage (ii) | £85,150 to £140,870 | Reduced or removed ability to work with some epilepsy risk from moderate to modest intellectual deficit. |

| Less severe post traumatic stress disorder | £3,710 to £7,680 | Minor symptoms but virtually a full recovery within 1-2 years. |

| Chest injuries (g) | Up to £3,710 | Soft tissue injuries and rib fractures. |

| Digestive system traumatic injury (iii) | £6,190 to £11,820 | Seat-belt pressure injuries. |

| Minor neck injuries (i) | £4,080 to £7,410 | Minor injuries lasting 1-2 years. |

| Minor back injuries (i) | £7,410 to £11,730 | Non-surgical recovery from back injuries within 2-5 years. |

| Other arm injuries (b) | £36,770 to £56,180 | Serious forearm fractures with significant permanent disability. |

| Severe leg injuries (Serious) (iii) | £36,790 to £51,460 | Serious compound or comminuted fractures or injuries resulting in extensive scarring, pain and near-certain arthritis. |

| Nose or nasal complex fractures (i) | £9,990 to £21,700 | Multiple or serious fractures needing surgery or resulting in permanent damage. |

| Facial disfigurement (b) Less Severe Scarring | £16,860 to £45,440 | Significant psychological reaction from substantial scarring. |

Special Damages

To recover costs related to your injury, you could claim under special damages. In order to do so, however, you must be able to prove your expenses. You can do this by saving bills or receipts that might be relevant for example.

You could recover costs for:

- Cosmetic materials. This could include special makeup to conceal your injuries and scarring.

- Therapy not covered by the NHS. If you require therapy to cope with any psychological injury.

- Lost wages. Loss of earnings if you were out of work to recover from your injuries, for example.

To discuss what evidence you could submit for special damages and what general damages you could claim for your work-related injury, contact our advisors.

Learn More About Making A Car Accident At Work Claim

If you would like to make a car accident at work claim, you might like to hire legal representation. The claims process could seem easier with a solicitor.

The financial risks associated with hiring a lawyer could be minimised with a No Win No Fee arrangement, such as Conditional Fee Agreement (CFA). There are no upfront solicitor fees when you use a No Win No Fee solicitor. Instead, if your claim is successful, a success fee will be taken from your award. This is subject to a legal cap.

Our advisors are waiting to discuss your potential car accident at work claim. They can advise on what evidence you could submit to strengthen your claim, as well as discuss what you could recover under special damages. Eligible claims might be passed onto our panel of personal injury solicitors.

To get in touch:

- Start your Claim online

- Call 020 3870 4868

- Use the live chat features

Resources

We’ve provided some links you might find helpful:

If you would like to learn more about making a car accident at work claim, we have more guides:

- Do No Win No Fee Scams Exist?

- Cosmetic Injury Claims – How Victims Could Claim Compensation

- What To Do If Injured in a Car Accident

The Whiplash Reform Program

If your injury occurred on or after 31st May 2021, the new Whiplash Injury Regulations 2021 could apply. The Whiplash Reform Programme is for injuries valued at £5,000 or less and is applied for through an online portal. A solicitor could help assess your injuries before you claim through the programme.

The reform applies to people over the age of 18 who, at the time of the crash, were:

- the driver of the vehicle; or

- the passenger of the vehicle

Once your claim is settled, you cannot reopen it if more injuries become apparent. Talk to our advisors today for free legal advice on making a car accident at work claim.

Writer IW

Checked by HT